What are Bookkeeping Services and Why are They Important? SG Small Business Center

Contents:

Bookkeeping tasks provide the records necessary to understand a business’s finances as well as recognize any monetary issues that may need to be addressed. Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health. While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional. It also includes more advanced tasks such as the preparation of yearly statements, required quarterly reporting and tax materials. By logging and keeping track of all financial transactions, you will have easy access to any financial information you might need. To make it even easier, bookkeepers often group transactions into categories.

Sabrina covers small business, entrepreneurship, and business finance topics for The Balance. Whichever accounting method you choose, the best way to make sure you’re dotting your i’s and crossing your t’s is to maintain order in the way you manage your bookkeeping. When creating the company’s balance sheet, the FIFO method of valuation offers costs that most closely resemble the costs most recently incurred. Computerized ― This is done through the use of accounting and bookkeeping software. Makes tax filing easier ― Having organized and accurate books can cut back the time and effort your client spends on tax filing. The accountant can focus on finding opportunities for tax deductions, which can save both money and time.

He ensures that bills are paid on credit memo so as to avoid any delay in deliveries or holding back of supplier credit. There are many different tasks a bookkeeper might be expected to do, depending on the size and structure of the organization they work for. If a bookkeeper owns their own business, they’ll doe everything mentioned above as well as more! It is crucial that a bookkeeper has an eye for detail and enjoys doing a wide range of administrative tasks.

Introduction to bookkeeping

However, for the novice, the introduction of bookkeeping-specific vocabulary and the rules that govern proper bookkeeping processes can be overwhelming. The chart of accounts may change over time as the business grows and changes. If you are going to offer your customers credit or if you are going to request credit from your suppliers, then you have to use an accrual accounting system.

FASB Issues Exposure Draft for Crypto Assets – Clark Nuber PS

FASB Issues Exposure Draft for Crypto Assets.

Posted: Tue, 11 Apr 2023 08:25:36 GMT [source]

While you can certainly buy a ledger book at an office supply store, keep in mind that it’s much easier to set up your chart of accounts if you’re using an accounting software, such as Wave. Many small companies don’t actually hire full-time accountants to work for them because of the cost. Instead, small companies generally hire a bookkeeper or outsource the job to a professional firm. One important thing to note here is that many people who intend to start a new business sometimes overlook the importance of matters such as keeping records of every penny spent.

Very https://1investing.in/ but well done course for an introduction to bookkeeping concepts. It is not a hands-on how-to course but does provide a basic overview of the bookkeeper position and some terminology. Bookkeepers track the materials and goods purchased for the business in the purchases account. You use this to calculate the COGS, and you subtract it from sales to determine the company’s gross profit. This refers to the money spent to purchase or manufacture the products or services the business sells.

Are bookkeeping and accounting different?

This is especially important for payments you make to vendors who will need a 1099 Form at the end of the tax year. And a Certified Public Accountant, or CPA, is an accountant who has taken a test called the Uniform CPA Examination and met your state’s requirements for state certification. While CPA licensing requirements vary from state to state, they usually include a bachelor’s degree in accounting and at least a year’s worth of on-the-job experience. To maintain their license, CPAs have to continue taking courses throughout their careers. As a business owner, you can accomplish these tasks with bookkeeping software, or you can hire a bookkeeper to do them for you.

- Locking the books so the books cannot be changed after the end of period closing has been completed .

- QuickBooks Live connects bookkeepers with small businesses that need help doing their books.

- One important thing to note here is that many people who intend to start a new business sometimes overlook the importance of matters such as keeping records of every penny spent.

- You will dive into the accounting concepts and terms that will provide the foundation for the next three courses.

Retained earnings accumulate, meaning they reflect the total amount of money retained since the company’s launch. If properly updated, it doesn’t take much time to manage this account. In the retained earnings account, bookkeepers monitor any profit the company makes that isn’t paid out to owners and investors.

How to Become a Virtual Bookkeeper

At least one debit is made to one account, and at least one credit is made to another account. While they seem similar at first glance, bookkeeping and accounting are two very different mediums. Bookkeeping serves as more of a preliminary function through the straightforward recording and organizing of financial information.

Tesla Korea Suspected of Accounting Misconduct Be Korea-savvy – The Korea Bizwire

Tesla Korea Suspected of Accounting Misconduct Be Korea-savvy.

Posted: Fri, 14 Apr 2023 04:35:58 GMT [source]

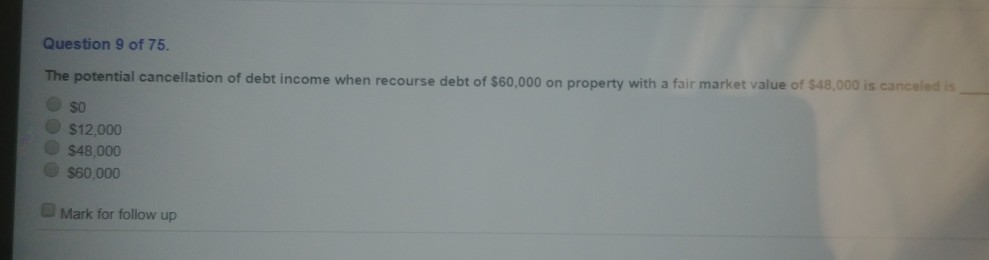

You check your financial records and find that business has been slower this year, and your estimated net taxes owed will only be $2,900 this year. In this case, you can still pay your taxes as a lump sum at the end of the year. However, if your business was steady this year and you once again owe over $3,000, you’ll need to start paying by quarterly instalments.

Tracking your finances gives you the full picture of your overall financial situation so you can maintain business growth and learn from what’s happened along the way. Better technology and specific software help your bookkeeper immensely, tailoring how they keep track of business transactions and receipts in a way that fits your needs. Your cash flow statement reconciles the income statement to the balance sheet and answers the question, “Where did the cash go? In the late 18th and early 19th centuries, the Industrial Revolution provided an important stimulus to accounting and bookkeeping. The rise of manufacturing, trading, shipping, and subsidiary services made accurate financial records a necessity.

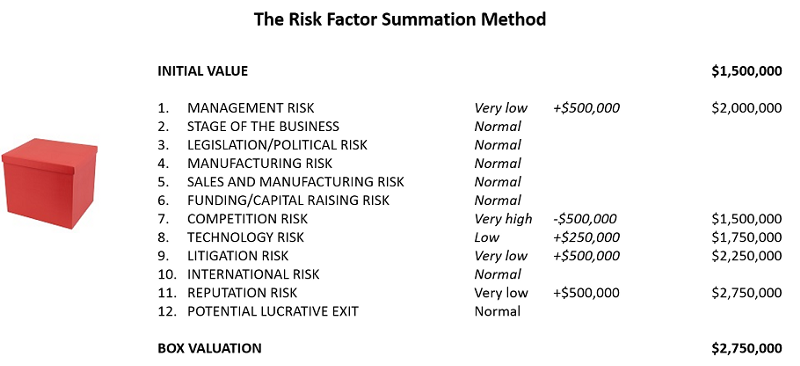

Accounting takes that information and expands on it through analyzing and interpreting the data. Not only can this help you set goals, but it can also help you identify problems in your business. With an accurate record of all transactions, you can easily discover any discrepancies between financial statements and what’s been recorded. This will allow you to quickly catch any errors that could become an issue down the road.

Illustrations and checklists let readers make sure they understand key concepts. This is the first course in a series of four that will give you the skills needed to start your career in bookkeeping. If you have a passion for helping clients solve problems, this course is for you. In this course, you will be introduced to the role of a bookkeeper and learn what bookkeeping professionals do every day.

CPAJ News Briefs: FASB, IASB – The CPA Journal

CPAJ News Briefs: FASB, IASB.

Posted: Tue, 11 Apr 2023 07:00:00 GMT [source]

In Master Intuit QuickBooks Online, readers can get guidance regarding tools and menus they will encounter when using the program. The author gives a rundown of the most common mistakes bookkeepers encounter and explains solutions to help users avoid similar errors. The best practices and procedures described in these pages come from real-world experience, providing important insight into situations users are likely to encounter. This book is not only recommended by accounting/bookkeeping professionals but also by CPAs and business owners who often need to train their subordinates in bookkeeping.

One good place to start your search for a bookkeeper is through Quickbooks. A ProAdvisor can assist you with small-business bookkeeping and installing or learning how to use cloud accounting software. This is the step that usually gets skipped when doing your bookkeeping solely from bank feeds.

In the case of limited or incorporated businesses, the process ends with the accountant’s year-end account preparation. There are also people who, like you, make a career out of bookkeeping by either working with a company or starting a bookkeeping business. Accounting is more subjective, as it provides insights for the business based on the information gathered through bookkeeping. Accountants create the internal controls that run the bookkeeping system properly. They also analyze and verify the information recorded by bookkeepers. As they keep track of daily financial operations, bookkeepers can tell business owners what’s financially feasible and what isn’t.